5 Ways Investing In Stock Market For Long Terming Will Help You Reinve…

페이지 정보

작성자 Erika 댓글 0건 조회 35회 작성일 24-06-01 06:57본문

Introduction:

In today's economic climate, high interest rates can have a significant impact on investment decisions. Whether you are a novice investor or a seasoned financial expert, it is important to understand how to navigate the market during periods of rising interest rates. This article will delve into the various strategies that investors can employ to maximize their returns in a high interest rate environment.

Observational Research Findings:

One of the first things to consider when investing during high interest rates is the impact on fixed income investments. Bonds, which are typically seen as a safe and stable investment option, can be particularly sensitive to changes in interest rates. As interest rates rise, existing bond prices tend to decrease, which can result in losses for investors who sell their bonds before maturity. However, investors who hold onto their bonds until maturity will still receive the full face value, making them less vulnerable to fluctuations in interest rates.

In contrast, stocks tend to perform well during periods of high interest rates. This is because companies can often increase their prices in response to higher interest rates, which can lead to higher profits for investors. Additionally, stocks offer greater potential for long-term growth compared to bonds, making them an attractive option for investors looking to capitalize on market opportunities.

Another investment option to consider during high interest rates is real estate. While rising interest rates can make it more expensive to obtain a mortgage, the overall impact on real estate investments tends to be less severe. In fact, some investors view high interest rates as a sign of a strong economy, which can lead to increased demand for real estate. Additionally, real estate investments can provide a steady stream of income through rental payments, making them a viable option for investors looking to diversify their portfolios.

It is also important to consider the impact of high interest rates on inflation. Inflation tends to increase during periods of rising interest rates, which can erode the purchasing power of fixed income investments. As a result, investors may want to consider allocating a portion of their portfolio to assets that can help hedge against inflation, such as commodities or real estate.

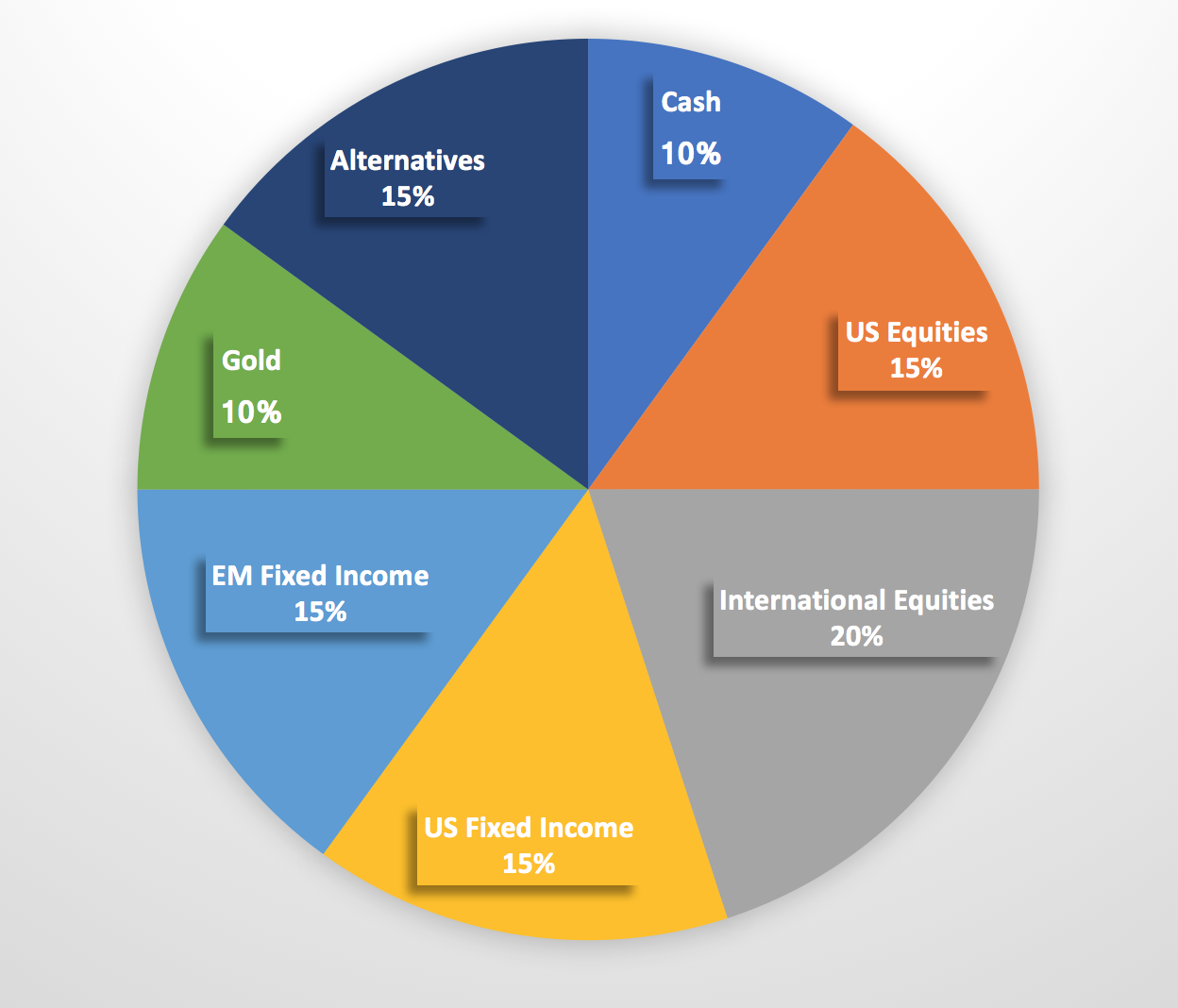

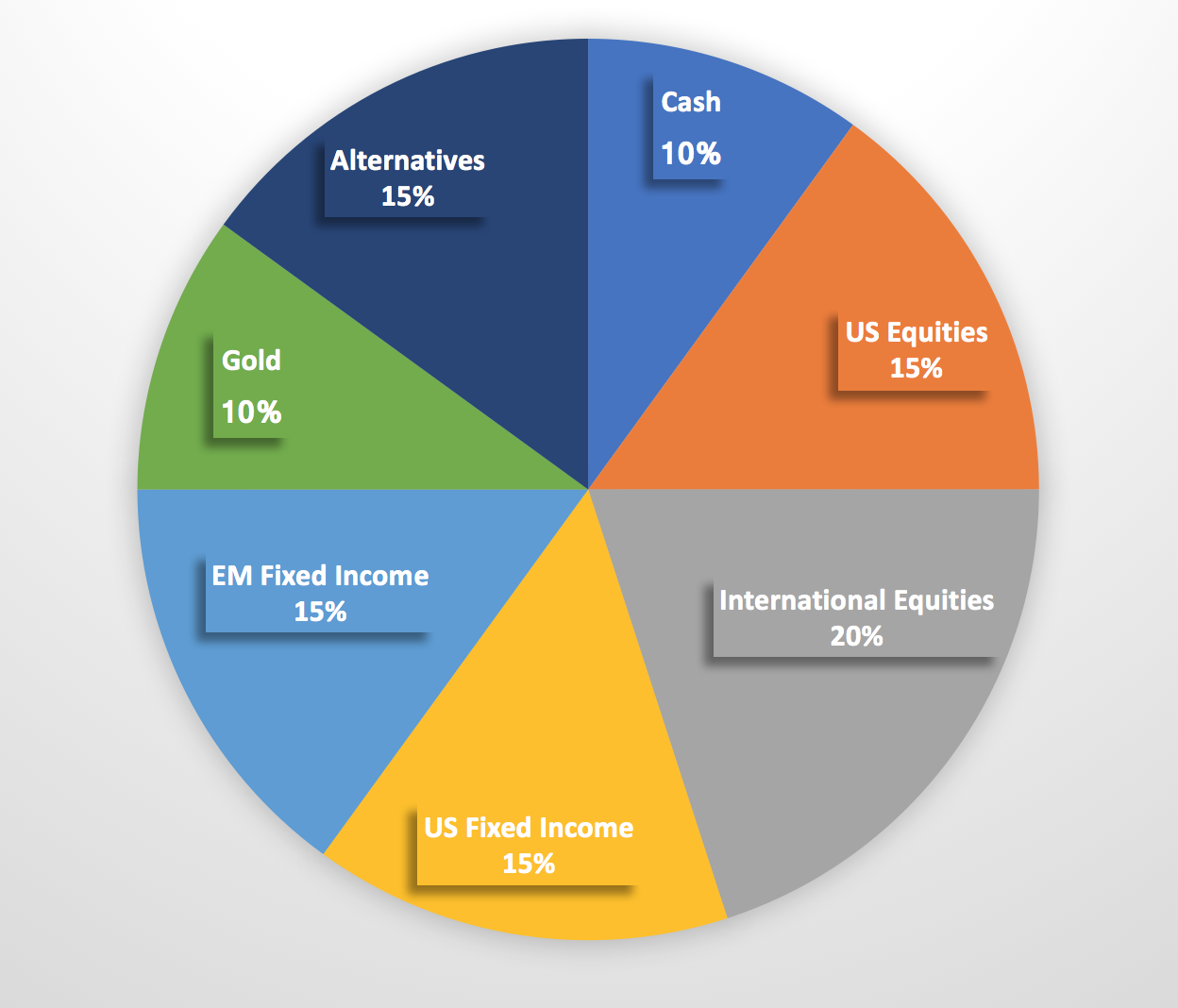

Overall, the key to successful investing during high interest rates is to diversify your portfolio and consider a mix of investment options. By spreading your investments across different asset classes, you can help mitigate the impact of interest rate fluctuations and potentially increase your overall returns.

Conclusion:

In conclusion, investing during high interest rates requires careful consideration and strategic planning. By understanding the impact of rising interest rates on different investment options, investors can make informed decisions that align with their financial goals. Whether you choose to focus on stocks, bonds, real estate, or a combination of assets, it is important to stay mindful of market trends and adjust your investment strategy accordingly. With the right approach, investing in stock market for long term during high interest rates can lead to significant returns and long-term financial success.

In today's economic climate, high interest rates can have a significant impact on investment decisions. Whether you are a novice investor or a seasoned financial expert, it is important to understand how to navigate the market during periods of rising interest rates. This article will delve into the various strategies that investors can employ to maximize their returns in a high interest rate environment.

Observational Research Findings:

One of the first things to consider when investing during high interest rates is the impact on fixed income investments. Bonds, which are typically seen as a safe and stable investment option, can be particularly sensitive to changes in interest rates. As interest rates rise, existing bond prices tend to decrease, which can result in losses for investors who sell their bonds before maturity. However, investors who hold onto their bonds until maturity will still receive the full face value, making them less vulnerable to fluctuations in interest rates.

In contrast, stocks tend to perform well during periods of high interest rates. This is because companies can often increase their prices in response to higher interest rates, which can lead to higher profits for investors. Additionally, stocks offer greater potential for long-term growth compared to bonds, making them an attractive option for investors looking to capitalize on market opportunities.

Another investment option to consider during high interest rates is real estate. While rising interest rates can make it more expensive to obtain a mortgage, the overall impact on real estate investments tends to be less severe. In fact, some investors view high interest rates as a sign of a strong economy, which can lead to increased demand for real estate. Additionally, real estate investments can provide a steady stream of income through rental payments, making them a viable option for investors looking to diversify their portfolios.

It is also important to consider the impact of high interest rates on inflation. Inflation tends to increase during periods of rising interest rates, which can erode the purchasing power of fixed income investments. As a result, investors may want to consider allocating a portion of their portfolio to assets that can help hedge against inflation, such as commodities or real estate.

Overall, the key to successful investing during high interest rates is to diversify your portfolio and consider a mix of investment options. By spreading your investments across different asset classes, you can help mitigate the impact of interest rate fluctuations and potentially increase your overall returns.

Conclusion:

In conclusion, investing during high interest rates requires careful consideration and strategic planning. By understanding the impact of rising interest rates on different investment options, investors can make informed decisions that align with their financial goals. Whether you choose to focus on stocks, bonds, real estate, or a combination of assets, it is important to stay mindful of market trends and adjust your investment strategy accordingly. With the right approach, investing in stock market for long term during high interest rates can lead to significant returns and long-term financial success.

- 이전글유작‘탈출: 프로젝트 사 24.06.01

- 다음글10 Facts About Shopping Online Sites That Make You Feel Instantly The Best Mood 24.06.01

댓글목록

등록된 댓글이 없습니다.